Community Features

Saving, couponing and the forum can be overwhelming when you don’t know what all the acronyms and unusual words mean.

A/C: After Coupon

BB/ BBF: Best Before

BOGO or B1G1: Buy One, Get One (free) – watch for the small print on this, it could be BOGO 1/2 price in which yo get the second half price

CO: Cents Off

CFK: Cash For Kids (a coupon program that donated a portion to childrens charities)

Exp: Expiry Date

FaR: Free After Rebate

FPC: Free Product Coupon (This gives you the coupon free and usually includes tax)

FT: For Trade

HBA: Health and Beauty Aid

HV: High Value

IP: Internet Printable coupon

LF: Looking For

MIR: Mail-In Rebate

NED: No Expiration Date

OOP: Out Of Pocket

OOS: Out Of Stock

Overage: Using a coupon for more than the item price to ‘earn’ extra money towards other purchases

OYNO: On Your Next Order

PM: Price Match

Peelie: A coupon attached to the product packaging for “peel off”

POP: Proof of Purchase

PP: Purchase Price

RC: Rain Check

RAOK: Random Act of Kindness

RP: RedPlum

SCOP: Scanning Code of Practice

SC: Smart Canucks (www.smartcanucks.ca)

SMP: Specially Marked Packaging

SPC: Student Price Card

STACKING: Using more than one coupon per item.

SASE: Self-Addressed Stamped Envelope

SS: Smart Source (a coupon booklet)

Tear-pad: A paper pad of coupons, usually located on the shelf or display for tearing off and use at check-out

TFT: Toonies for Tummies (a coupon program that donated a portion to childrens charities)

TL: Trade List

TMF: Try Me Free

Train: Coupon train

VWT: Virtual Wishlist Train

WL: Wish List

WYB/WUB: When You Buy

YMMV: Your Mileage May Vary

Stores & Products:

BB: Best Buy

FS: Future Shop

LD: London Drugs

P&G: Proctor & Gamble

NF: No Frills

RCSS: Real Canadian Super Store

SDM: Shoppers Drug Mart

SS: SuperStore

WM: Walmart

NF: No Frills

Often used on online coupon forums:

BFF: Best Friend Forever

BTW: By The Way

Bump: Nice way of pushing a thread back to the top of the page

DH: Dear/Darling Husband (or replace the D with less nice words) DW (wife) DS (son) DD (daughter) etc

FB: Feedback (in trading) or Facebook

HTH: Hope That Helps

LMK: Let Me Know

NP: No problem

OEM: Original Equipment Manufacturer (Not Retail)

OP: Original Poster (Person who started the thread)

Mod: Moderator

PM: Private Message

Report: clicking the star button to the left of a post will alert mods to an issue in that post (rude, spam, etc)

SAHD: Stay At Home Dad / SAHM: Stay At Home Mom

TY: Thank You

TIA: Thanks in Advance

TTT: To The Top (aka BUMP)

Thanks to tech_gurl who posted most of these in our forums

Any other words you ever wondered about

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

Ever been shopping and the item scans higher than advertised? You could be getting that product free!

The Scanning Code of Practice is a voluntary code (although many stores do participate) through the Competition Bureau and Retail Council of Canada.

If the scanned price of a non-price ticketed item is higher than the shelf price or any other displayed price, the customer is entitled to receive the item free, up to a $10 maximum. When the item has a price tagged, the lowest price applies. When identical items are incorrectly priced, the second one will be sold at the correct price.

The Code covers all scanned merchandise at participating retail outlets where the sign shown above is displayed at the store entrance or checkout. You have probably seen it before and never read it, but it can save you money.

What is a non-price ticketed item?

A non-price ticketed item is any bar coded merchandise that does not have a price affixed to the merchandise.

What happens if two or more identical non-price ticketed items are incorrectly scanned?

Customers are entitled to the first item free (up to a maximum of $10) and the subsequent item(s) at the correct price. If the items are different flavours/scents(different PLU or UPC numbers) they are classed as different items and you can get them free.

Do you need to do anything to get this discount?

Simply ask, often the cashier will try to just put the item in at the corrected price – politely point out the sign and ask if you should not be getting it free (or $10 off). They may need to get a manager’s approval and will usually send someone to check the price.

What if the item has been put back in the wrong place?

Most companies list the item details on the price tickets, but on occasion there will be a big sign with just a price. If there are many of that item you can likely argue for it, but if it is a single item with others not like it – probably not.

What if the ticket price shows a date that has expired?

This one is a judgment call, the date shows that the price is no longer valid but they have to show pricing as part of their agreement. They will usually honour it in this case but you may need to point out that it is their responsibility to take down the old tags and that small print is just a false advertising attempt.

Do all stores take part in this code?

No, it is recommended to stores but not required. Quebec does have price accuracy laws but they are not covered by this voluntary code (although the terms are very similar)

What if they won’t give me the discount?

First ask for a manager and explain the situation. If you are still dissatisfied, register a complaint with the Scanner Price Accuracy Committee, by calling 1-866-499-4599 (toll free).

What is the best item you have ever got with SCOP?

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

There are so many misconceptions to couponing in Canada, from people thinking you must be poor or on welfare to coupon to people who have watched Extreme Couponing and think it is that easy to get hundreds of items for free at one time.

Canada does not have the same rules as the US, few stores allow store coupons with manufacturers’ coupons, double and triple coupons are a special event that may happen a few times a year – if that and most of our grocery stores do not give you coupons on your receipt.

That being said, you can save a lot by couponing if you are willing to give up your brand loyalty and spend the time doing it – and for some, the time just is not worth the savings.

If you are brand new to couponing, my first piece of advice is don’t go crazy. It can be so tempting to buy things just because they are cheap. By couponing, you can build a stockpile when items are cheap (or even better, free) but if you won’t use them – why buy them? Don’t buy stuff you do not need just because it is cheap with coupons.

My second – no coupon is too small. Ever seen a coupon and thought it is only $0.50 off a $3 item and not bothered picking it up? If you buy that item anyway, why pay $3 when you can pay $2.50. You by one every week, you save $26 over the year – do that on 4 items and you have an extra $100 by the end of the year.

Getting Coupons – you will need coupons to start, you won’t start saving until you build a stash of coupons.

- Check your stores – now is the perfect time as many people are finding the newest coupons in stores (don’t bother with Loblaws banner stores or Walmart – they rarely carry manufacturers’ coupons). The ones I found this week include $2 off any fruit or produce when you buy 2 loaves of Dempster’s bread which we buy regularly anyway.

- Many traders on SmartCanucks will trade ‘newbie packs‘ with an assortment of coupons, others will trade based on your wishlist or if you see coupons you are interested in, you can contact that trader to arrange a trade (I will cover trading in-depth later this month)

- Online coupons – check our coupon page to find the coupons you can order. Many come from sites such as save.ca, websaver.ca, smartsource.ca, or gocoupons.ca – you will need to sign up for these sites – one per address (smartsource is a limit per computer). Some will be available to print, others will be mailed to you. Many companies offer occasional coupons on their sites or from their facebook pages.

- Check your newspapers – occasionally there are coupon inserts in newspapers, this weekend was one of them!

- Contact companies and ask – tell them you love their products and ask if they have any coupons available. Be polite, many will say no but ones sent directly from the companies are often great coupons that can be used on any product they sell.

- Check packaging for coupons, cereal often has coupons in the box and this will be advertised on the box.

What you will need

- Scissors: Many mailed coupons and coupon inserts require the coupon to be cut out.

- Some type of coupon organizer – many of us started with an envelope, then a little accordion file from Dollarama then moved up to binders or coupon organizers. I will cover organizers in-depth soon too.

- Paperclips (great for sorting coupons and holding stacks together – never staple coupons)

- The simple stuff (paper, pen, envelopes (great for throwing a few coupons in for a small shop or mailing trades) and a calculator (use it on your phone or computer if you don’t have one)

You can get all of these at a dollar store if you don’t have them.

- Printer – if you don’t have one, it can be a bit of an expense but many coupons are now printable and are time limited so you can miss out if you need to wait for someone else to print it for you. It is best to get a colour printer as cashiers may claim they are photocopied if black and white.

- A mailing address (easy right) Some coupons will not be mailed to a PO Box though.

While you are building a stash of coupons, start working on a price book. Make a list of all the items you usually buy (including competing brands) with their prices. Many stores put items in their flyers that are not really on sale, they just hope people buy them because they are advertised. Couponing is most effective when you know your pricing.

Once you have some coupons, you are ready to start.

- Check store flyers for prices that are lower than usual (we do this for you, check our coupons to use with flyers thread in the deals & flyers forum each week).

- Make a list of items you want to buy and clip your coupons to your list (I find it easier to put my list on an envelope for each store with the coupons in the envelope)

- Bring your extra coupons with you in case you see clearance deals while shopping.

- Sort your items when checking out to make sure you can give the cashier the coupon for that item – ask them how they prefer the coupons. Watch to make sure all the prices ring up as advertised.

Some tips

- Unless it is a really great sale you will make the most of your coupon by buying the smallest size you can. If you only have one of a coupon, it may be worth buying the bigger size (If you need 10 of something, buying a cheap pack of 4 but still needing to buy 6 more may not be economical).

- Check what your local stores’ policies are on printable coupons and coupons over the amount of an item – they may not accept it. Many couponers favour Walmart for their generous coupon policy.

- Make sure you read the terms of your coupons carefully. Many exclude certain products or sizes or are only available on a certain size.

- Some cashiers do not like couponers, you will eventually get to know the coupon friendly ones.

- If you have a list of items that are cheap at various stores, you can save time and money by price matching at one store (Walmart, RCSS, FreshCo or No Frills plus some smaller ones).

- If you live in Western Canada, certain stores allow the use of more than one coupon per item (stacking).

- If you are new to couponing, and especially if you want to trade coupons, I recommend signing up to Adopt-A-Newbie (which you can find here). You will be paired with a senior trader who can help you on your couponing journey. When you sign up, let them know if you live in Western Canada so you can be matched with someone who can teach you about stacking.

Over the coming weeks, we will cover some of these points more in-depth but this should give you an idea of whether couponing is for you.

For the couponers reading – what is the one piece of advice you would give someone starting out? Feel free to sign up as an adopter in our Adopt a Newbie thread too.

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

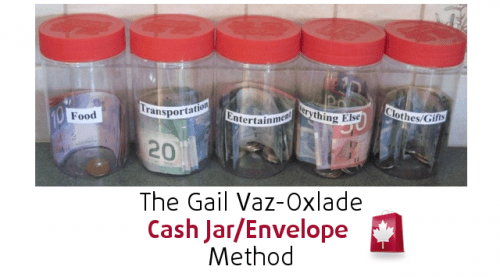

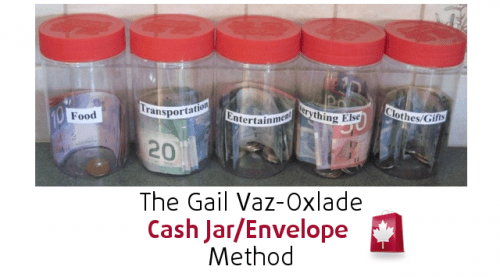

When we tried the cash jar method, it was something that both of us agreed to and were pretty careful about making sure the budget would work, but this was not the case with all of my ideas for saving and paying off our debts.

No money management idea will work if your whole family are not onboard with the idea. Meal planning gets ruined by a child crying for pizza, your cash jars go out the window when someone comes home with a large purchase not discussed beforehand, someone goes to the bar after work and your entertainment budget for the month and more is gone. For me, our biggest issue was getting the small spending under control, the coffees and donuts and grabbing a sandwich for $7 in Toronto because you didn’t make a lunch. Once those were under control, we looked for ways to cut our budget further to pay off debts quicker and save more.

That was when I started couponing, and when we had the most issues with family disagreements over budgeting. Although he seemed to be onboard with the cash jar idea from the start, deep down he felt like a child waiting for Monday for a new allowance when he knew money was sitting in our accounts. He liked the idea of saving money more than actually doing it. Couponing just pushed him over the edge. He thought, like many, that people would think we were poor and look badly on us because of it, he was embarrassed standing in line with a coupon.

So we came to an agreement, our budget was already where we wanted it to be, we were paying down debts, saving and the majority of the time, staying within our jar amounts (with some borrowing from other jars) but he wanted that freedom we had before – so we agreed to a non jar allowance on top of the money we had allotted to ‘everything else’ as a personal allowance of 20% of whatever we saved or earned extra. As many on the SmartCanucks’ forums know, I have a nail polish addiction – that ‘reward’ money pays for those ‘wants’ that I don’t need. So if I want to buy that extra $10 nail polish, I need to find $50 in savings from our budget or earn an extra $50 that month and he gets a matching $10 too. The other 60% gets divided between savings and debt. He was soon offering to work on Saturday or asking why don’t I have a coupon for an item when it went directly into his pocket.

For others, the hardest is giving up a certain name brand, especially for kids. One week it is Quaker granola bars because they were on sale, the next it is store brand, one week iogo yogurt, the next Astro. You have all seen the kid crying in the grocery store because it has to be a certain kind, but giving in will not help you long term. If your children are old enough, explain that their allowance or hockey equipment comes from the savings. Give them some reward for helping you in your goals.

Meal planning works well, especially if you have a treat day, as they can look at the plan on the fridge and know they can have that pizza tomorrow. It is not just a no.

A friend pays her daughter $1/week on top of her allowance to help clip and sort her coupons and look through the flyers and match them up with her (and her younger brother’s) favourites. Her daughter is learning from a young age how to budget and about earning money (I think she gets more excited than me about the flyers being early). She has a folder with their favourite items and how much she will pay for them. Once the proper grocery list is done, they are given $10 to spend on treats from that price sheet. If they can find them in the flyers, they can have them. She updates this monthly or so according to coupons she has so they just need to look at the flyer price and she worries about the coupons. If they don’t spend it all, it goes into a ‘fun jar’ and they use it for movies and towards their next Disney vacation – something they never could have afforded several years ago before saving and couponing. Then if she does have to take them to the grocery store with her, ‘their job’ is to find their own items which distracts them from the usual ‘mommy I want this’ arguments.

“I realize this may not be for everyone, but after years of “helping” me grocery shop by throwing whatever they wanted in the cart, it is a happy medium. Amelia really does enjoy helping and is learning great tools for the future.”

Obviously this is not for everyone, but as she mentions, her children were used to the choice and choosing what they wanted at the grocery store – so if you are starting out in the same situation, it may help you ease your children into the couponing/saving lifestyle.

Yes, saving is not meant to be fun, but you will be more likely to stick to it if there is some reward at the end of it all (other than savings and paying off your debts). It is all about what reward works for you.

What advice do you give to those starting out on getting their families into the SmartCanucks lifestyle?

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

It is as simple as don’t spend more than you earn, right? Sure, but you could still be living paycheque to paycheque. When we first tried the Gail Vaz-Oxlade method of budgeting using cash jars/envelopes, we were badly overspending. We were all too fond of putting it on our credit card and worrying about it later. I remember filling out the form on her website and wondering what we were spending another $1000 a month on – now we know exactly where we spend our money so if we do need to cut back, we know where we can cut first.

Expenses: Gail Vaz-Oxlade recommends that of your total income, 35% goes to housing, 15% to transportation, 25% on “life” (everything from groceries, pets, kids etc), 15% to debt and 10% to savings. If you walk most places or have no debt, obviously these will change – but savings in your budget should go to savings, not just be spent because you have it.

Budget what you can afford to spend based on your income (budget worksheet here). You will be amazed how much you need to spend compared to how much you actually do spend. If you have no idea what you spend on “life”, spend January following the tips on SmartCanucks and tracking your spending then fill in the budget sheet.

Once you have your numbers, setup your jars or envelopes. You will need

- Transportation (above fixed costs)

- Groceries/Personal Care

- Entertainment

- Clothes & Gifts

- Everything Else

You will have a monthly allowance that goes into each of those jars, you can add a percentage of the budget weekly, bi-weekly or monthly – however you get paid. Remember that some money in the jar is for costs that month and some are meant to accumulate. Keep the money from each jar in that jar for upcoming expenses. If you run out of grocery money, cut the entertainment or an optional ‘everything else’ expense for that week and use it for food – but make sure it is coming from optional spending, not accumulated surplus for say a dentist visit or oil change.

Keep a notebook and track all spending, then enter it into your tracking sheets, which are as simple as this:

Get a receipt for everything, even that coffee from Tim Hortons to remind you of what you are spending. I put my receipts in my jars until the end of the week so we both can see where money is being spent, and so we can make sure it gets tracked.

Most importantly, give yourself some non tracking allowance for each week, it doesn’t have to be big but the freedom will help you stay on track with the other jars. If it fits in the other jars, use that money but if you want something frivolous, use the allowance.

You will be amazed how much you save living just on the money in those envelopes, set up a high interest savings account and put a portion of your newly unspent money towards savings, another portion in a curveball/rainy day fund and use the rest to pay down your debts.

If you are reading this because you have debts, start by calling them – ignoring the calls will not help. Tell them that you now have say $100 per month in your budget for them, ask if they can lower your interest rate to help you pay it off. Try going to the bank to consolidate the debts with one payment with a lower interest rate. If that doesn’t work – start with the largest interest rate, its costing you more in the long term. Pay the minimum on the others and pay down what is costing you the most. For some people, this may be a really annoying debt collector, but not your biggest bill – but if it is getting you down and costing you emotionally, pay it first.

Let us know how you are doing using this system

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

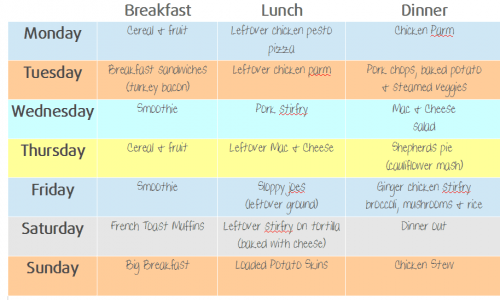

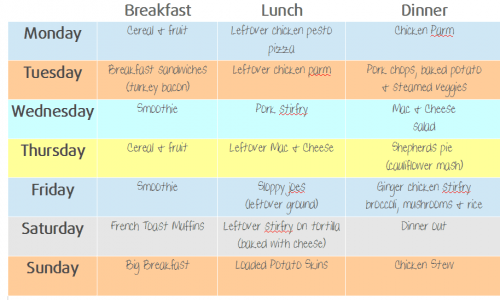

You know how it is, you get home, you are tired and still have housework to do and order a pizza or Chinese or you start making your favourite recipe only to find you are missing a key ingredient. Meal planning can save you both time a money.

Personally, I am not into one day cooking, but it works for lots of SmartCanucks members. We do use leftovers from dinner for lunches the next day to save on cooking a second time or buying additional food.

Meal planning can help you save in several ways

- You buy less at expensive prices

- You waste less

- You eat out / eat convenience foods less (healthier too!)

- You spend less time deciding what to cook

How to plan your meals

First, see what food items you have. If you already have chicken in the freezer, why pay more for it this week, wait for it to go on sale. Make a list to see what you have and think about what meals/recipes match them and what other items you will need to make those meals.

Then it is time to get out those flyers. See what is cheap this week. If pork tenderloins or packs of ground chicken are on sale – plan your meals around those and buy extras to freeze for weeks when meat is expensive. SmartCanucks makes this easy with our weekly ‘Produce & Grocery Staples Deals’ thread)

Make a list of meals with the ingredients beside them. I keep my favourite recipes on index cards and just pull out 6 for the week (we always factor in going out or getting a pizza). If I know it will be a busy week, I include something like frozen pizza depending on what is on sale that week. It is just the two of us, so when I cook, I cook for 6 – we eat that night, have a lunch portion for the fridge and another dinner portion for the freezer. If we eat out one night, we can use those dinner portions for lunches.

Write (or print) your meal plan. How often have you been on your way home and realised that you forgot to take something out of the freezer. Having a copy on your fridge will remind you to get that meal ready.

Write out your shopping list. I price match many of my groceries at Walmart, FreshCo or No Frills rather than going store to store. That way I can get the best deals without spending too much time to save the extra money. We will be covering price-matching in a future blog.

Go Shopping. Stick to your list but have another meal in your head in case something is not in stock or if there is a store special for a great deal.

It is a good idea to research budget recipes before planning, some good sites to start with are:

AllRecipes – Simply Recipes – Canadian Living – Eating Well – SkinnyTaste

There are lots of different meal planners online, but feel free to use mine here pdf

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

Not really a deal but I know many of you have been looking for gluten free products.

Some of these have been available in select Loblaws banner stores for a while but they are rolling them out to more stores. Check your local Loblaws store (Loblaws, Superstore, RCSS, Fortinos etc) to find a wider selection of PC Brand gluten free products including white sliced bread, cookies, muffins, brownies and cake loafs.

The pricing shown above is for my local Fortinos store.

As I mentioned in an earlier blog, I used to go to the same grocery store weekly, with roughly the same list yet my bill really varied. We bought the same brands because we were used to them, we picked up whatever looked interesting. Typical shoppers. Now I cringe when I am behind someone with a cart full of items knowing they can save so much more.

Everyone knows the usual rules for not overspending when shopping; shop alone, with a list and never on an empty stomach, but there is so much more to saving on groceries.

Look at the price per unit and per weight. Two similar items can be priced similarly, say a box of granola bars for $1.99 but one may have 6 while the other has 8 in the box. The bars in the box of 8 may be slightly smaller, but you will likely only eat one anyway. Save the calories and the money.

Buy in bulk (when not using coupons). Things like lentils, rice, pasta and spices are often cheaper when bought in bulk if you do not have a coupon. Bulk Barn often offers coupons for $3 off when you spend $10 or more. Buy some containers to store them and save on these items.

Spend now to save later. If you have been trying to save on your groceries for a while, you know that some weeks, the deals are just awful. Stock up on pantry items or foods that can be frozen when they are cheap. For example, Metro recently sold extra lean ground chicken for $2.49/lb (reg $3.99/lb on sale). We went several times and grabbed 4 and stocked our freezer with 12 packs of roughly 1lb each). Just before Christmas, FreshCo offered pricematching of Grade A turkeys for utility turkeys. I pricematched Food Basics at $0.77/lb for a 12lb turkey, it was under $10 and will make many meals to come.

Buy in season or frozen. Fruit and vegetables are obviously much cheaper (and fresher) when bought in season. If you still want those summer berries, buy frozen. Meats can be high in sodium when frozen, opt for fresh if you are watching the sodium intake.

Do your own food prep. A stir-fry vegetable kit may seem cheaper when you compare it to buying each of the items separately, but you often only need less than half of those items so can use them for multiple meals. Boneless/skinless meats are much pricier than their boned counterparts, a whole chicken can be much cheaper than buying breasts and legs.

Don’t be brand loyal. Whether it is because you have a coupon or because a certain brand is on sale – you can save a lot by buying different brands. I have tried many brands because of a discount that I likely would not have bought before joining SmartCanucks but I now love and buy regularly. Don’t be afraid to try store brands for those items that do not have coupons, they are often made by the major manufactures anyway.

Meatless Mondays (or any day). Swap out meat for a cheaper protein such as lentils or beans – you will save money and your body will thank you for it.

Check the discount racks. Get to know your store staff and find out when they mark down produce and meat. In some stores (especially the more expensive chains) they mark down meat that is much fresher than other stores so you need to do some investigating to find the best stores. Just by shopping at the right time, you can save 30% on meats and produce. Either cook or freeze them when you get home. This really does depend on the store, comparing my local stores one marks down produce that looks fresher than the full priced produce in another, one very rarely has any mark downs other than breads and another the meat needs to be slimy and green before they would consider marking it down.

Meal Planning. Plan your meals based on sales. I will cover this more in-depth later but you can save a lot of money by planning what you are going to eat so you are not buying last minute items at a convenience store or using items meant for another meal.

Couponing. As I mentioned earlier, couponing is not for everyone but if someone gave you $20 gift card to a grocery store, you would use it, no? Why not let the manufacturers pay for your products. Some couponers will even trade gift cards for coupons, so you can get free produce for giving away those coupons you don’t need. You may think that there are no coupons for healthy items, but there are. Last year I got free fruit and yogurt from cheap cereal, produce from $1 ziplocs etc I will cover this more in-depth too.

Loyalty Programs. Is your store offering bonus points on an item you buy often? Do they have a bonus event when you spend a certain amount. Usually you can use coupons to reduce this amount. Do you have a high value coupon that they are offering bonus points on? Use those bonus points to buy the produce and meat.

Each week, we do the work for you – check here for the best lists of deals on meat, produce & grocery staples, coupon matchups and baby deals.

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

The best way to meet your long term goals is to set short term ones. If you have been overspending, the shock of a frugal lifestyle can be a bit much but cutting down bit by bit can set you in the right path for the future.

Start with the easy stuff

Bills: are you paying too much?

TV: Not all of us are ready to “cut the cord” but you can go down to a basic package for TV. For my local cable company, Digital Basic is $32 but their recommended 3 theme pack package is $68, most of us have a few add-on channels plus the savings in taxes. Just by changing, you save $500/year.

Home Phone: Do you really need one? Many people keep their phone for ‘security’ purposes but if it uses electricity, it is useless. If you use it, great but for me, it is just another way for telemarketers to call me. You can save $20+ a month getting rid of the line, more with all the extra fees they charge.

Cell Phones: Do you need the plan you are on? Many people are not on the right plan for them. They either have a cheaper plan and pay overage or an expensive plan that they don’t use. Even a savings of $10 a month adds up over the year. Call and ask if they have a plan that matches your usage better.

Internet: Do you need that high speed connection? Does your bandwidth match your usage? Many websites do not work at the super high speeds cable companies offer. Unless you have a lot of devices using the connection or another reason for needing the speed, 6-8mbps (or even less) packages are just fine – even for streaming! Check what monthly bandwidth they offer on the smaller packages or you could end up paying more for usage.

Decide if these services are a must for you and where you can cut. Giving up even channels on your cable package may seem like a big move but in a month or so, you won’t even remember having them. Call the companies, explain that you need to cut expenses and ask what they can offer you. Often their customer retention department will have much better offers than they show online but be careful they are not trying to upsell you!

Banking: Are you paying too much in fees? Get a fee free account (like the one available from PC Financial) or check to see if your bank have a cheaper package that suits your usage. Can you use your debit card less to save $5-10 a month? That $60-120 a year pays another bill.

Mortgage: Are you paying monthly? Can you change it to bi-weekly, you will get more payments in and pay down your mortgage more quickly. Can you remortgage to a better rate?

Utilities: Most utility companies offer a better rate for off-peak usage. Do that laundry in cooler water and at an off-peak time to save.

Groceries: You Gotta Eat

I used to buy roughly the same thing every week, if chicken was on sale I would buy that instead of beef, more broccoli instead of cauliflower etc but yet my grocery bill for just two of us could range from $100-130 a week, plus the bits we picked up during the week and eating out. Now I pay $50-70 a week and often much less.

If you are really trying to cut expenses – stop eating out now! Keep it as a treat and something you save for in other areas of your finances. It is easy to spend even $10 per person at a fast food place now and a restaurant – easily $50 for a couple. Do that even once a month and it adds up over the year. If you don’t brown bag lunches for work or school – start now. Coffee stop every morning? Make it at home!

SmartCanucks has a large couponing community, and it is a great way to save but not for everyone, it takes organizing, time, and can actually cost a little more in the short term as you build a stockpile. However, you can save a lot just by paying attention to sales, flyers and buying what is cheapest. Stores like No Frills, RCSS, Walmart and Freshco offer price matching on your groceries. You do not need to go store to store to get the deals. Spend an hour planning your meals, shopping and you can easily save $20 on every shopping trip.

There is also a lot to be said for the cash method recommended by Gail Vaz-Oxlade but you need to spend January working out a reasonable budget or you will give up (trust me, I have been there). Start with the saving tips all over SmartCanucks and take another 10% off for February as you will save more as you learn. For automatic withdrawals I just put an IOU in that jar so I “see” the money.

We will cover these more in coming blogs, but you have a lot to get you started.

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

Often we see a lot of new members join SmartCanucks on January 1st as people set goals to spend less, save more or other financial goals. Over the coming days and weeks, we will be posting some blogs about frugal basics and the site in general to help those new members on their SmartCanucks’ journey.

The site can be a little overwhelming when you first arrive, there is a lot of information in different sections, the blog will have updates on the latest sales and coupons available online, but throughout the forums and other sections you will find in-store tear pad coupons that people have found, and sales that may interest you but are not posted on the blog as they don’t appeal to a wider audience so it is a good idea to check across the site.

Let us know what you want to save on, we are here to help.

Start by introducing yourself in our Welcome Lounge, meet our mods, community helpers and helpful members. If you are interested in couponing, check in with our Adopt a Newbie section where you will be paired with a seasoned couponer and trader who can help you. Then venture into the other parts of the forums and see what interests you.

For those longer term members, it is time to clean out the coupon binders, make a new wishlist, and sign up for those once a year freebies and coupons – a fresh start for the new year.

We are looking forward to helping you save money this year!

I have finally finished sorting my coupons and said a teary goodbye to some good coupons I should have used before they expire tonight.

How many coupons did you throw away? Which 2012 coupon will you miss the most?

With 2013 fast approaching, what are your saving and couponing goals and resolutions for the new year?

We will be living off our stockpile for a while, there is little we need to buy until we use up what we have bought with the exception of fresh foods. I also plan to be more aware of whether I need items I am buying and not just buy them for points or for my stockpile unless it fits within a 1 year allowance of that item as I just donated some of my bathroom stockpile because I had too much toothpaste, shaving cream and shower gel.

I also want to track my spending better, we don’t overspend overall but I want a better idea of where we are spending so we can save more. Each year I seem to track well until mid March then the tracking just drops off and I don’t bother.

Well, you’ve got to hand it to them: Canadian retailers are not going down without a fight. This year there are a record number of Black Friday sales and for the first time ever there are an increasing number of Black Friday Week sales. Canadian retailers are rising up against their United States competition and sending a clear message: “Canadians will stay home this year on Black Friday”.

However, we would not be very smart here at Smart Canucks if we didn’t alert you to the fact that not all of the Canadian Black Friday deals are all that great. Please be aware that although the retailers will come at you with flashy signs and midnight madness, there are still better deals found south of the border. I am certainly not encouraging people to ignore the sales found right here at home. In fact, I highly suggest people search for deals in Canada first and then compare them to those found in the US. If the better deal is in your own backyard, by all means shop to your hearts content and support the Canadian economy. However, if the Black Friday deals in the USA can’t be beat, then go and save yourself a loonie. Bottom line: be a smart and savvy shopper. Do your research and stretch your dollar. Oh, and remember to have fun!

Do you plan on shopping in Canada this Black Friday? Or will you go where the better deal is (even if it means crossing the 49th parallel?)

Help the Heart and Stroke Foundation’s Guinness World Records attempt to break the record for the largest CPR training session ever by training the most people at one time in one place on October 25th at Wonderland.

Tickets are $14.99 and you must take part in a 30 minute CPR training session. Gates open at 5:30 and close at 6:45 and the park will be closed to the public for the night. You will have full access to the park and rides until midnight. Buy your tickets here (they will not be available at the gates)

You will also be given a Heart & Stroke Foundation Family & Friends Kit as you leave (limited number available, no information on what they include).

Note: you must be 13 to attend and it is not a CPR certification course.

I love Tim Horton’s Smile Cookies, it is a way to give back while getting something yummy for me and a nice change from all the companies asking for just $1 a day for life signups.

Buy a $1 smile cookie before September 23rd and the entire proceeds of the cookie sale will go to a local charity. Check to see which charity is supported in your community here.

Page 6 of 14« First«...5678...»Last »