Pizza Hut Canada

Veggie Lovers Pizza, Hershey's Chocolate Dunkers

Until Sunday, get a free Hershey’s Chocolate Dunkers from Pizza Hut Canada when you purchase a large veggie lovers pizza. In Saskatchewan you must order the extra large size to get the Hershey’s Dunkers. Click here to visit the Pizza Hut Canada Facebook page and place your order online.

Call it Spring Canada

Shoes, Sandals, Boots& Handbags,

Get an extra 50% off all clearance at Call It Spring Canada. This offer is valid until Monday, February 11, 2013. Also, Call It Spring is offering free shipping for a limited time, on all online orders over $45 after applied discounts and before taxes.

Click here to get Call It Spring offer .

Starbucks Canada

Starbucks whole bean coffee,

Starbucks Canada has an awesome online new deal. Buy any one 1lb bag of Starbucks whole bean coffee, and get the second one free. Starbucks offer is valid until Friday, February 22, 2013. This offer excludes Guatemala Casi Cielo and Starbucks Reserve coffees.

Click here to get Starbucks store locator.

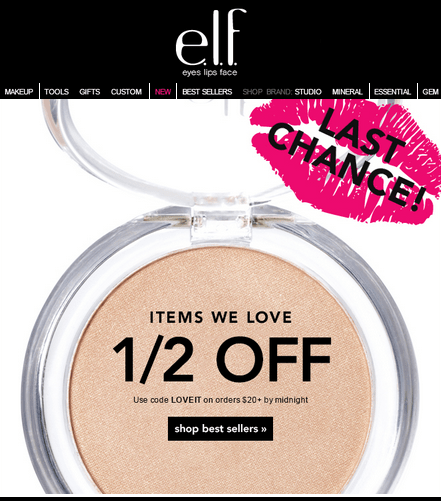

e.l.f. Cosmetics Canada

50% off e.l.f. Best Sellers on orders of $20 or more. Enter coupon codeLOVEIT at checkout. Your discount will be calculated as 50% off each item in the Best Sellers category. This e.l.f. offer is valid until Monday, February 11, 2013. Max Discount is $100.

Some of the e.l.f. best sellers items are:

- 11-piece Brush Collection for $30

- 144-piece Ultimate Eyeshadow Palette for $15

- Endless Eyes Pro Eyeshadow Palette for $10

- Endless Eyes Pro Mini Eyeshadow Palette for $5

- Makeup Clutch Palette for $15

- 141 piece Master Makeup Collection for $35

- Mechanical Eyelash Curler for $1

- Stipple Face Brush for $3

- High Definition Powder for $6

- Lip Exfoliator for $3

- HD Blush for $3

- Makeup Remover Cleansing Cloths for $3

- Super Glossy Lip Shine For $1

- Luscious Liquid Lipstick For $1

- Waterproof Eyeliner Pen for $1

- foundation SPF 15 for $5

Click here to get e.l.f. offer.

VIA Rail Canada

VIA Rail is offering you 50% off the adult regular fare in all service classes for travel throughout Canada until June 15, 2013 inclusive. Advance purchase is not required. This offer ends February 14, 2013.

Click here to book your ticket.

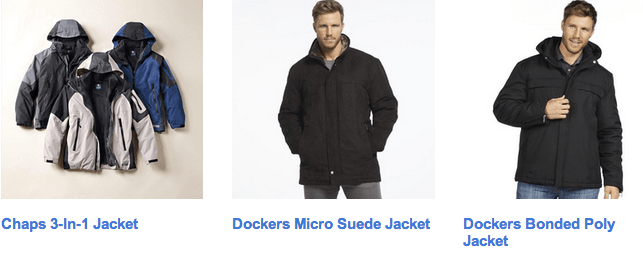

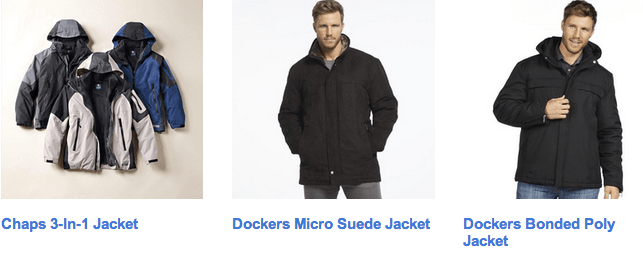

Sears Canada, Canada

jackets & Coats

Sears Canada is offering up to 50% off selected jackets & Coats. This is a limited time offer.

Sears Canada is offering up to 50% off selected jackets & Coats. This is a limited time offer.

Click here to shop at Sears Canada.

Yucatan Guacamole are giving away 10,000 coupons for $4 off over the next 3 days. There will be 3,333 available today starting NOW.

Click here to get your coupon (facebook only)

Aeropostale Canada

Aeropostale Canada has an awesome late night sale. Get $20 off $80 from 7:00 PM to 6:00 AM. This Aeropostale deal is valid on Monday, February 11, 2013. Enter coupon code 20FEB at checkout to get your discount.

Click here to shop at Aeropostale.

well.ca Canada

Today only, you can get a Lysol No Touch Hand Soap Dispenser (not the kit, just the dispenser) for $1 from well.ca with free shipping if you spend $25 or more or $2.99 if you spend less. They have the soap refills for $4.99 but you can find them cheaper in Walmart.

Other sales:

and more. If you are a new customer and are not paying by paypal, enter FEBLOVE to save $10 off a purchase of $40 or more. Click here to shop online at well.ca

Thanks for letting us know about the dispenser price Missy Montreal

Cinnabon Canada

CinnaPack coupons

Get your coupon NOW from Cinnabon FB. 3,000 50% off CinnaPack coupons are available. 50% Cinnapack are redeemable from Wednesday, February 13, until Monday, March 4, 2013 in ONT and NS only. Oh I am so excited 🙂 Click here to get this Cinnabon FB deal NOW!

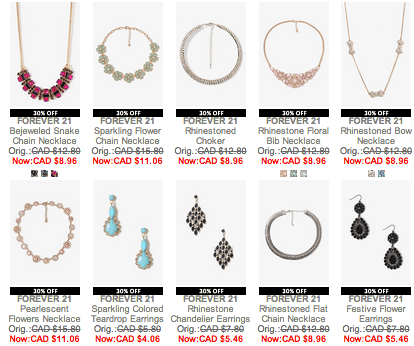

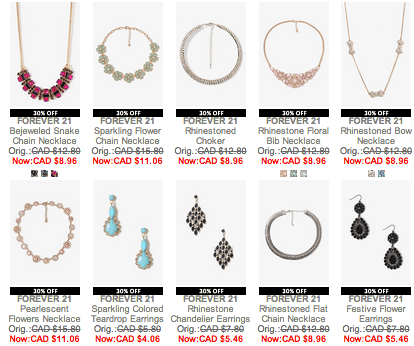

Forever 21, Canada

lingerie & jewelry

Take 30% off select lingerie and jewelry at Forever 21. This offer is valid on regular priced merchandised only. Forever 21 deal is valid until Wednesday, February 13, 2013. Also, Forever 21 is offering free shipping on orders of $60 or more.

Click here to get Forever 21 deal.

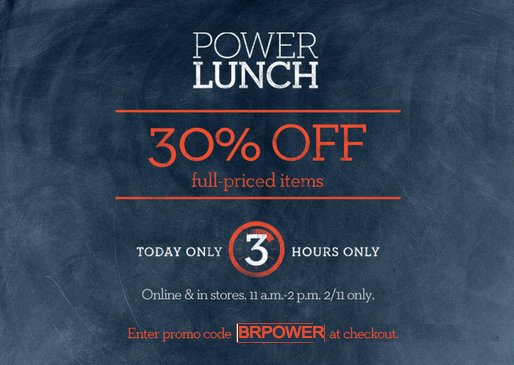

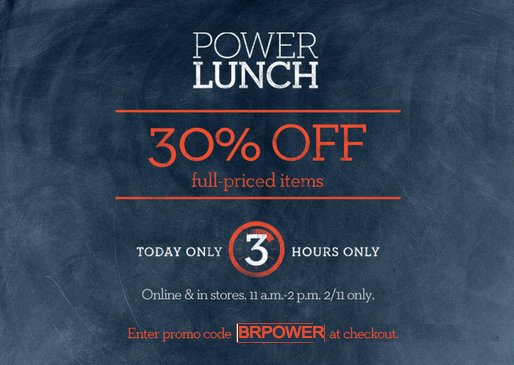

Banana Republic, Canada

Banana Republic Canada is offering 30% off full-priced items. This offer is available online and in-stores. This Banana Republic deal is valid on Monday, February 11, 2013, from 11 a.m until 2 p.m only or while supplies last. Enter promo code BRPOWER at checkout to get the discount.

Click here to shop at Banana Republic.

Chocolate Philadelphia Cream Cheese

From the Philadelphia Cream Cheese Canada Facebook page:

“Who wants free chocolate? Join our community, Real Women of Philadelphia, soon for exclusive member-only coupons.”

We will keep you posted when further details are available. In the meantime, click here to join the Real Women of Philadelphia community if you are not already a member.

Has anyone tried the Chocolate Philly yet?

Coach, Canada

Bags,

Coach has an awesome offer. Take an additional 50% off all bags (discount applied at checkout) plus enjoy free shipping on orders of $150 and more. This offer is available at Coach Factory online. Coach Factory deal is is valid until Tuesday, February 12, 2013 or while supplies last. If you are looking for some gift ideas for Valentine’s day, enjoy these elegant bags from Coach Factory :).

Click here to get this Coach deal.

Subway Canada

Subway are offering a printable coupon for a free cookie on Valentine’s Day with no purchase needed through facebook (sent to your email so you can print it later or show it on your phone). One free cookie per customer per visit. Not good with any other coupon offers or discount card.

Click here to claim your coupon (amounts may be limited)

Page 5,571 of 6,597« First«...5,5705,5715,5725,573...»Last »

Sears Canada is offering up to 50% off selected jackets & Coats. This is a limited time offer.

Sears Canada is offering up to 50% off selected jackets & Coats. This is a limited time offer.