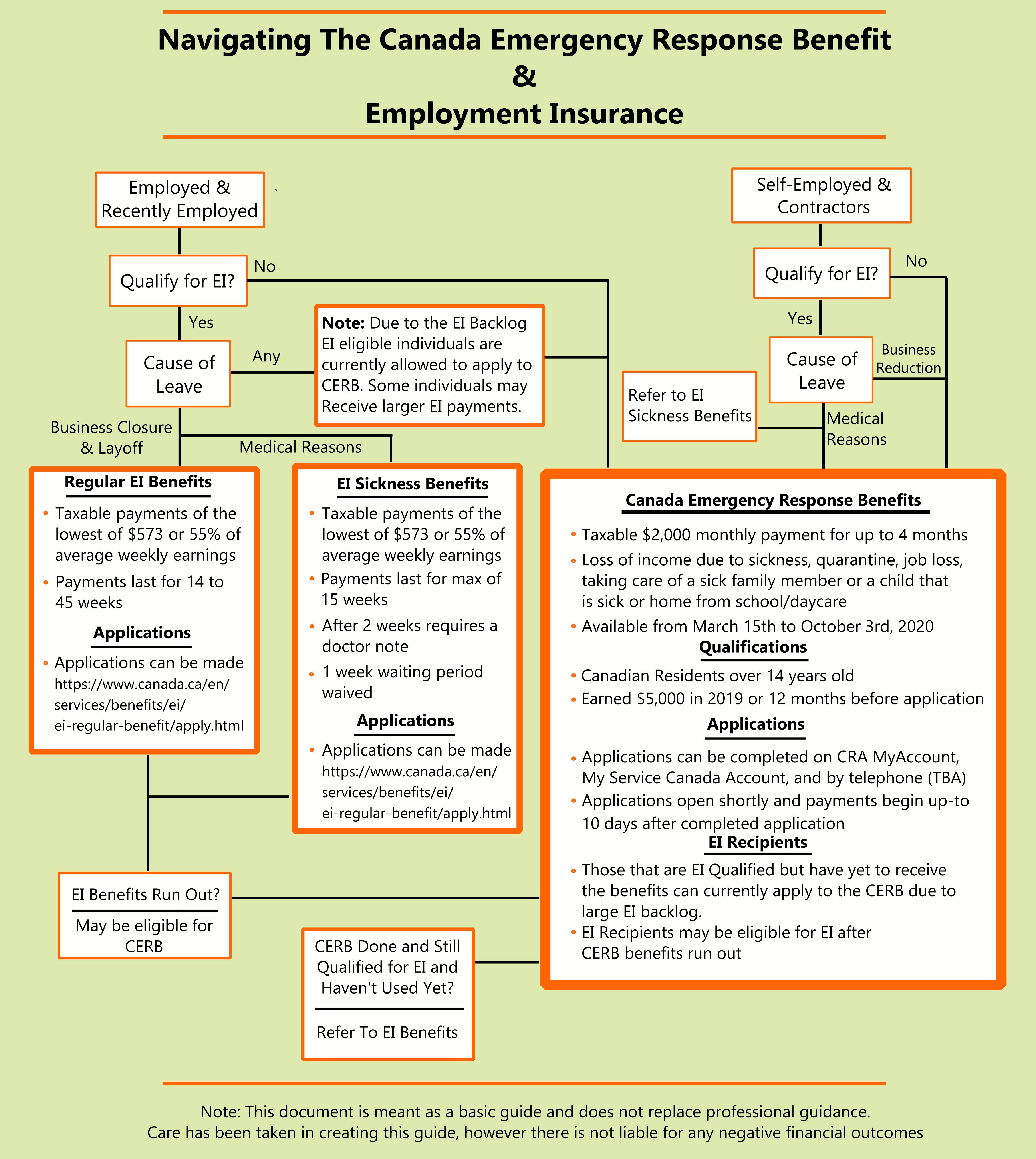

I thought the graphic above would help give you an idea on how to navigate the new Canada Emergency Response Benefit & Employment Insurance.

A bit more info:

Employed individuals who have not lost any income do NOT qualify for CERB.

To qualify for CERB, an employer or self-employed ceases working for at least 14 consecutive days within a four week period and do not receive any income or benefits (unstated at this time). The individual cannot be eligible for EI (however, the government is exempting this factor for now due to the EI backlog).

The reason for the loss of work can be due to being sick, quarantine, taking care of an individual that is suffering from a quarantine, and taking care of a child that is sick or home because of school closure. Individuals that also are employed, but do not receive income due to work interruptions are also eligible.

The recipient also needs to be a Canadian resident, be at least 15 years old, and have earned $5,000 in employment, self-employment income, or maternity/parental benefits in 2019 or the twelve months before their CERB application.

hahaha this situation has become a mess.

Our Governments are a giant Joke.

First think this is a great idea…However, it will leave out some with the $5000 min qualifier. So if someone JUST started working PART TIME, say a younger person in the last 5 months part time, they would be excluded. This as they have not made $5000

What about the people who are working to serve everyone that’s off, making little more then minimum wage, they should be offering us a little extra !

So I am considered a contract worker, and qualify under those terms listed. However my 2019 income tax hasn’t been filed yet. Will that affect my eligibility?

This is good but I can’t help but think of my son who works in a grocery store. He’s earned more than $5000 in 12 months so would qualify for the $2000 monthly. However, because he works in a grocery store, work is available to him, so he does not qualify. He earns likely $1000/month. Putting himself at risk, going to work, to earn less. There’s a problem with this. Don’t get me wrong, I don’t want to not see people get it, but as it stands it’s a very unbalanced scale for those who show up to work every day making minimum wage.

Self-employed persons who opted into paying EI premiums (program option since 2015?) likely would qualify for EI if they paid into the program. Once self-employed opt into EI premiums, they cannot opt back out.

I saw something on a union website for workers on temp layoff recently-the union leadership indicated that if members had an EI file from Jan when an earlier shutdown period applied, members were not to apply for CERB but go back into their earlier EI file to claim March layoff weeks for benefits.

CERB is a taxable benefit-hope all recipients take a look to see how much federal tax will be deducted from benefit payments or else plan to set aside 13% to help offset any income tax surprises when doing 2020 tax returns next year.

My accountant friend told me EI for self-employed is good for people who are planning to get pregnant so i never opted in, thank f*k lol.

And to christopher… yeah a lot of people hate our government. The gov can’t please everyone after all. I think they are doing what they can. After last few weeks I’ve come to understand we’re more fortunate than say…ahem, our neighbors in the south.