It is as simple as don’t spend more than you earn, right? Sure, but you could still be living paycheque to paycheque. When we first tried the Gail Vaz-Oxlade method of budgeting using cash jars/envelopes, we were badly overspending. We were all too fond of putting it on our credit card and worrying about it later. I remember filling out the form on her website and wondering what we were spending another $1000 a month on – now we know exactly where we spend our money so if we do need to cut back, we know where we can cut first.

Expenses: Gail Vaz-Oxlade recommends that of your total income, 35% goes to housing, 15% to transportation, 25% on “life” (everything from groceries, pets, kids etc), 15% to debt and 10% to savings. If you walk most places or have no debt, obviously these will change – but savings in your budget should go to savings, not just be spent because you have it.

Budget what you can afford to spend based on your income (budget worksheet here). You will be amazed how much you need to spend compared to how much you actually do spend. If you have no idea what you spend on “life”, spend January following the tips on SmartCanucks and tracking your spending then fill in the budget sheet.

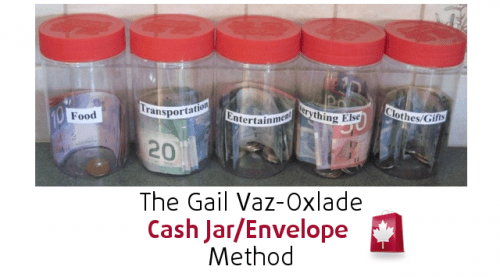

Once you have your numbers, setup your jars or envelopes. You will need

- Transportation (above fixed costs)

- Groceries/Personal Care

- Entertainment

- Clothes & Gifts

- Everything Else

You will have a monthly allowance that goes into each of those jars, you can add a percentage of the budget weekly, bi-weekly or monthly – however you get paid. Remember that some money in the jar is for costs that month and some are meant to accumulate. Keep the money from each jar in that jar for upcoming expenses. If you run out of grocery money, cut the entertainment or an optional ‘everything else’ expense for that week and use it for food – but make sure it is coming from optional spending, not accumulated surplus for say a dentist visit or oil change.

Keep a notebook and track all spending, then enter it into your tracking sheets, which are as simple as this:

Get a receipt for everything, even that coffee from Tim Hortons to remind you of what you are spending. I put my receipts in my jars until the end of the week so we both can see where money is being spent, and so we can make sure it gets tracked.

Most importantly, give yourself some non tracking allowance for each week, it doesn’t have to be big but the freedom will help you stay on track with the other jars. If it fits in the other jars, use that money but if you want something frivolous, use the allowance.

You will be amazed how much you save living just on the money in those envelopes, set up a high interest savings account and put a portion of your newly unspent money towards savings, another portion in a curveball/rainy day fund and use the rest to pay down your debts.

If you are reading this because you have debts, start by calling them – ignoring the calls will not help. Tell them that you now have say $100 per month in your budget for them, ask if they can lower your interest rate to help you pay it off. Try going to the bank to consolidate the debts with one payment with a lower interest rate. If that doesn’t work – start with the largest interest rate, its costing you more in the long term. Pay the minimum on the others and pay down what is costing you the most. For some people, this may be a really annoying debt collector, but not your biggest bill – but if it is getting you down and costing you emotionally, pay it first.

Let us know how you are doing using this system

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

Don’t know who she is, but I’ve been using this envelope method for the past 12 years.

How do you know how much to start the jars off with? I’m new to this.

We do something similar, but instead of jars it is all done electronically on a computer spreadsheet. We have a yearly budget, and monthly tracking sheets. This way we can use a cash back credit card and earn money. It takes discipline not to be tempted to overspend on the CC, but we have the control. DONOT carry a balance on a cash back CC, you pay way too much interest! You MUST pay it off entirely monthly! If you stay within budget, you have no problem paying it off every month cuz the money is there. If you are tempted AT ALL to go over budget for the month do not use a credit card, use the jars or envelopes. This is very very sound advice. Gail has been our budget mentor for years! She taught me the downfalls of debt & interest.

Glad to find this simpler method, have tried finding something usable on microsoft templates but nothing seemed to work. With less income this year need to try this now. txs

we use a notebook from dollarama, the pages fit in a coffee jar or envelope

Even just writing on the outside of the envelope you take the money out in works

I like her shows. One thing I wonder…..if money problems are the leading cause of divorce and she is on her 4th…..ironic for sure.

Eric really? Do you own a tv or go to the library or a bookstore in the last 10 years?

I appreciate knowing the percentages attached to the various categories. My “life” category is going to include bank service charges. Should figure out how much of the “life” percentage relates to monthly bank fee…

We do something similar, but our categories are different. We have a certain amount dedicated to different stores (ie grocery store, walmart, shoppers, ect…) and then a “float” jar where we put money for misc stores/stuff. This has worked way better for us then having to keep track of what’s grocery vs household vs children ect…especially when you buy multiple “categories” at one store. We transfer the gas money onto a credit card every month so that we can pay at the pump (taking all the kids out of the car to go in to pay is a real pain!)

No idea who she is either! I always did this in my head but my husband and kids cant do that, so we use envelopes now.

This is retarded.

I don’t need this, I’m not poor.

You don’t need to be poor to have good money management skills

My husband and I been doing this for the last year…. and love it! We have control on what and where we spend.

We use this “jar” method at our house. the only thing we did not like was that after a while we had a load of cash just sitting around. With BMO(and maybe someother banks too?) we were able to set up free savings accounts so we could put our money in theose account and name them. The accounts we have are savings, vacation, emergency, pets, automobile, gifts and our daughter has her own account(seperate from her RESP’s). This seems to work well for us and also we get interest for having the money in the bank! 🙂

We actually do the same Kerri – we have a direct deposit into a “spending savings” account for a portion of the long term things like vet bills, auto etc

Alternatively, you could ask your bank to divide your paycheck automatically into different accounts just like the jars. I’d recommend getting several credit cards for different categories as well.

I use the MSN money’s “60% rule”, in which I spend only 60% of my income for regular expenses. 10% goes to retirement, 10% goes to long term savings, 10% goes to short-term savings, 10% goes to fun money.

I find it much easier to pay myself first and charge everything on credit cards so I have a record of where all my money goes.