Save $5 on the purchase of Purina Pro Plan Shredded Blend with this hidden coupon available by mail through Save.ca. Click here to order yours!

Save $5 on the purchase of Purina Pro Plan Shredded Blend with this hidden coupon available by mail through Save.ca. Click here to order yours!

Not many coupons available for gluten free products so is nice to see one that is not product specific. Their last Canadian one was just for Plentils. Save $1.50 on two Enjoy Life products when. Requires the smartsource printer to install.

Click here to print your coupon

Visit Softlips on Facebook for a printable coupon for $1 off any Softlips product. The coupon expires January 31st.

Clorox are offering a printable coupon for $5 off a Brita Water Pitcher. If printed today, it expires March 8th.

Click here to print your coupon

The January sales are starting now the Boxing Day sales are ending. Here is a round up of shoe and clothes store sales this weekend.

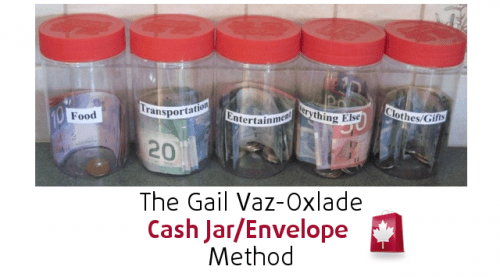

It is as simple as don’t spend more than you earn, right? Sure, but you could still be living paycheque to paycheque. When we first tried the Gail Vaz-Oxlade method of budgeting using cash jars/envelopes, we were badly overspending. We were all too fond of putting it on our credit card and worrying about it later. I remember filling out the form on her website and wondering what we were spending another $1000 a month on – now we know exactly where we spend our money so if we do need to cut back, we know where we can cut first.

Expenses: Gail Vaz-Oxlade recommends that of your total income, 35% goes to housing, 15% to transportation, 25% on “life” (everything from groceries, pets, kids etc), 15% to debt and 10% to savings. If you walk most places or have no debt, obviously these will change – but savings in your budget should go to savings, not just be spent because you have it.

Budget what you can afford to spend based on your income (budget worksheet here). You will be amazed how much you need to spend compared to how much you actually do spend. If you have no idea what you spend on “life”, spend January following the tips on SmartCanucks and tracking your spending then fill in the budget sheet.

Once you have your numbers, setup your jars or envelopes. You will need

You will have a monthly allowance that goes into each of those jars, you can add a percentage of the budget weekly, bi-weekly or monthly – however you get paid. Remember that some money in the jar is for costs that month and some are meant to accumulate. Keep the money from each jar in that jar for upcoming expenses. If you run out of grocery money, cut the entertainment or an optional ‘everything else’ expense for that week and use it for food – but make sure it is coming from optional spending, not accumulated surplus for say a dentist visit or oil change.

Keep a notebook and track all spending, then enter it into your tracking sheets, which are as simple as this:

Get a receipt for everything, even that coffee from Tim Hortons to remind you of what you are spending. I put my receipts in my jars until the end of the week so we both can see where money is being spent, and so we can make sure it gets tracked.

Most importantly, give yourself some non tracking allowance for each week, it doesn’t have to be big but the freedom will help you stay on track with the other jars. If it fits in the other jars, use that money but if you want something frivolous, use the allowance.

You will be amazed how much you save living just on the money in those envelopes, set up a high interest savings account and put a portion of your newly unspent money towards savings, another portion in a curveball/rainy day fund and use the rest to pay down your debts.

If you are reading this because you have debts, start by calling them – ignoring the calls will not help. Tell them that you now have say $100 per month in your budget for them, ask if they can lower your interest rate to help you pay it off. Try going to the bank to consolidate the debts with one payment with a lower interest rate. If that doesn’t work – start with the largest interest rate, its costing you more in the long term. Pay the minimum on the others and pay down what is costing you the most. For some people, this may be a really annoying debt collector, but not your biggest bill – but if it is getting you down and costing you emotionally, pay it first.

Let us know how you are doing using this system

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series

Burnbrae Farms (the makers of Egg Creations) are promising a giveaway of 650 coupons tomorrow evening to celebrate a year on facebook. You can also enter their contest to win a $50 prize pack. It is not clear if this is first come first served or a contest for the coupons.

Click here to visit their facebook page

This promotion is actually a chance to win these mitts (and bigger prizes) but many members are saying that they won today. There is a limited number available so try for yours soon.

Thanks sdddmd for a UPC: 058496812324

Enter here for your chance to win

Cineplex are offering Family Favourites movies on Saturday mornings at 11 for just $2.50/person.

Click here for more information

Burnbrae held their giveaway early, but if you missed it, they have 5000 coupons for buy one get one free on Egg Creations available on Facebook.

This is not a renewed coupon from the last one, so if you got one recently you can get another and you do not need to add extra coupons to your save.ca basket to checkout with this coupon.

Click here to get this coupon

Update: Fans, we are planning another giveaway this evening (650 coupons) for those who didn’t get a coupon this afternoon. (Limit of one per day.)

A new printable coupon for $1 off the purchase of Arctic Gardens frozen vegetables is available through the Canadian Living website. Click here to print yours. The coupon will appear on the right hand side of the page, under “Connect With Us.”

Oddduck has done her usual amazing job of compiling the best baby deals around from the flyers this week.

View the list of deals on diapers, baby food and more for the week of Jan 4-10 here

The Bath and Body Works Canada Semi Annual Sale continues this week with select Signature Collection body care now at 3 for $10! Complete the survey at the bottom of your previous receipt for your code to save an additional $10 on a $30 purchase. If you don’t have a receipt check out their Facebook page for additional coupons.

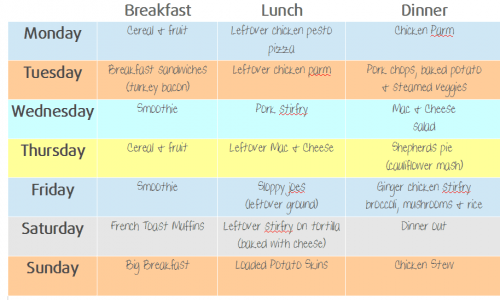

You know how it is, you get home, you are tired and still have housework to do and order a pizza or Chinese or you start making your favourite recipe only to find you are missing a key ingredient. Meal planning can save you both time a money.

Personally, I am not into one day cooking, but it works for lots of SmartCanucks members. We do use leftovers from dinner for lunches the next day to save on cooking a second time or buying additional food.

Meal planning can help you save in several ways

How to plan your meals

First, see what food items you have. If you already have chicken in the freezer, why pay more for it this week, wait for it to go on sale. Make a list to see what you have and think about what meals/recipes match them and what other items you will need to make those meals.

Then it is time to get out those flyers. See what is cheap this week. If pork tenderloins or packs of ground chicken are on sale – plan your meals around those and buy extras to freeze for weeks when meat is expensive. SmartCanucks makes this easy with our weekly ‘Produce & Grocery Staples Deals’ thread)

Make a list of meals with the ingredients beside them. I keep my favourite recipes on index cards and just pull out 6 for the week (we always factor in going out or getting a pizza). If I know it will be a busy week, I include something like frozen pizza depending on what is on sale that week. It is just the two of us, so when I cook, I cook for 6 – we eat that night, have a lunch portion for the fridge and another dinner portion for the freezer. If we eat out one night, we can use those dinner portions for lunches.

Write (or print) your meal plan. How often have you been on your way home and realised that you forgot to take something out of the freezer. Having a copy on your fridge will remind you to get that meal ready.

Write out your shopping list. I price match many of my groceries at Walmart, FreshCo or No Frills rather than going store to store. That way I can get the best deals without spending too much time to save the extra money. We will be covering price-matching in a future blog.

Go Shopping. Stick to your list but have another meal in your head in case something is not in stock or if there is a store special for a great deal.

It is a good idea to research budget recipes before planning, some good sites to start with are:

AllRecipes – Simply Recipes – Canadian Living – Eating Well – SkinnyTaste

There are lots of different meal planners online, but feel free to use mine here pdf

This blog is part of our New to SmartCanucks series, click here to read more blog posts in the series